Corporate Accounting & Taxation Diploma Course in Trivandrum

The Diploma in Corporate Business Accounting & Taxation (DCBAT) course in Trivandrum is a specialized program designed to provide students with in-depth knowledge of business accounting and taxation practices in a corporate setting.

Diploma in Corporate Business Accounting & Taxation (DCBAT)

The Diploma in Corporate Business Accounting & Taxation (DCBAT) is a specialized program designed to provide students with in-depth knowledge of business accounting and taxation practices in a corporate setting. This course equips learners with the skills required to handle complex accounting tasks, tax planning, and compliance processes efficiently.

Through a practical and industry-oriented approach, the DCBAT program covers topics such as corporate accounting standards, direct and indirect taxation, payroll management, GST compliance, TDS, and financial reporting. Whether you are an aspiring accountant, a working professional, or a business owner, this course serves as a comprehensive pathway to mastering corporate financial management.

Why Choose Inspiro Edutech for a Corporate Accounting & Taxation Diploma Course in Trivandrum

Inspiro Edutech stands out as the go-to institution for PDCFA training. Here’s why:

Industry-Expert Faculty

Comprehensive Curriculum

Hands-On Training

Real-World Case Studies

Flexible Learning Options

State-of-the-Art Infrastructure

Placement Support

Programme Structure

- Overview of banking and financial systems.

- Importance of computerized systems in modern banking and accounting.

- Fundamentals of accounting: assets, liabilities, equity, income, and expenses.

- The accounting cycle, ledger, trial balance, and financial statements.

- Key banking concepts: deposits, withdrawals, loans, and banking services.

- Banking operations: customer accounts, transactions, and reconciliation.

- Overview of computer-based banking systems and software (e.g., Finacle, Flexcube).

- SUnderstanding core banking solutions (CBS) and their functions.

- Introduction to accounting software used in banking.

- Recording transactions, generating reports, and maintaining ledgers.

- Bank reconciliation processes and procedures.

- Managing electronic funds transfer, NEFT, RTGS, and IMPS transactions.

- Bank reconciliation processes and procedures.

- Managing electronic funds transfer, NEFT, RTGS, and IMPS transactions.

- Cash management processes in banking: deposits, withdrawals, and cash flow.

- Overview of electronic payment systems: UPI, e-wallets, POS machines.

- Types of loans and advances offered by banks.

- Managing loan accounts: disbursements, repayments, interest calculations, and schedules.

- Goods and Services Tax (GST) and its application in banking and accounting.

- TDS (Tax Deducted at Source) and other tax-related processes in the banking system.

- Risk management techniques in banking and finance.

- Identifying and preventing fraud in banking operations using computerized systems.

- Regulatory framework governing banking operations in India.

- Compliance with KYC (Know Your Customer), Anti-Money Laundering (AML), and other banking norms.

- Practical assignments: working with banking software, processing transactions, and generating reports.

- Final project: Implementing a simulated banking scenario, including all accounting and banking operations.

Course Details

- Duration: 1 year

- Eligibility: Plus two/ Above

- Finance Support: EMI Option Available

- Certification: Govt/PSC Approved

Approved By

Register Now

Key Features

- Real-World Case Studies – Gain insights through practical applications and industry-relevant scenarios.

- Updated Course Content – Stay up to date with the latest amendments in taxation and corporate laws.

- Career-Focused Program – Prepares students for roles such as accountant, tax consultant, finance executive, and audit assistant.

- Flexible Learning Options – Ideal for students, working professionals, and business owners looking to enhance their accounting expertise.

- Industry-Recognized Certification – Boost your professional credibility with a diploma that adds value to your career.

The Diploma in Corporate Business Accounting & Taxation (DCBAT) at Inspiro Edutech is designed to equip students with the essential skills and practical knowledge required for a successful career in accounting and taxation. With a well-structured curriculum, hands-on training, and expert guidance, this program ensures that learners are industry-ready. Whether you are an aspiring accountant, tax consultant, or business owner, this course provides the necessary expertise to excel in the ever-evolving corporate finance and taxation landscape.

Career Opportunities

The DCBAT certification opens up a wide range of career opportunities in the field of accounting and taxation. Graduates can pursue roles such as:

- Corporate Accountant

- Tax Consultant

- Financial Analyst

- Payroll Manager

- Compliance Officer

- Accounts Manager

With businesses focusing on financial accuracy and tax compliance, there is a growing demand for skilled professionals in corporate accounting and taxation. Opportunities exist in sectors such as banking, finance, IT, manufacturing, and consulting firms, as well as in government organizations.

Why Inspiro Edutech Stands Out in Trivandrum, Kerala

Inspiro Edutech is a leading institution in Trivandrum, renowned for its quality training and student success. Here’s why we’re the preferred choice:

Experienced Trainers

Widespread Network

Proven Excellence

Affordable Fees

Customized Approach

Industry Recognition

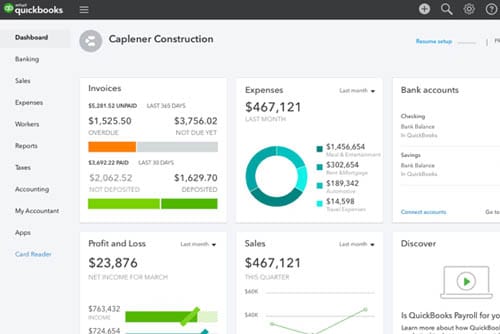

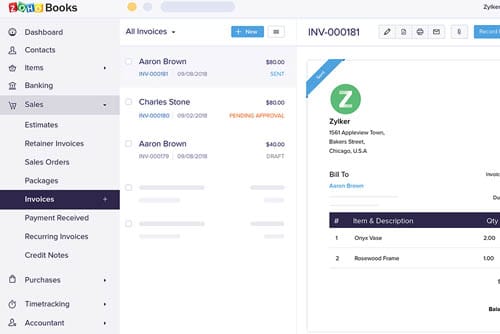

Software Tools Covered

Are you looking for Related Course?

Testimonials

What Students Says

Posted onTrustindex verifies that the original source of the review is Google. I did my Bim training from inspiro edutech Trivandrum. BI did it through online, but the support was super. The clash deduction class superPosted onTrustindex verifies that the original source of the review is Google. I did my Bim training at inspiro eduteck trivandrumPosted onTrustindex verifies that the original source of the review is Google. Best python training centre in Trivandrum. Government authorised certificate provided. Placement assistance. Did my online course with inspiroPosted onTrustindex verifies that the original source of the review is Google. Dear Inspiro Edutech Trivandrum, It was great joining your online course for interior designing and Marketing course. I received government authorised certificate plus job placement from inspiro Thanks InspiroPosted onTrustindex verifies that the original source of the review is Google. I completed my Bim architecture course from Inspiro. I belive it is one of the best training institute in Trivandrum. Inspiro delivers what they say. The proximity to Trivandrum railway station and. Bus stand is an added advantage for my commutation. It is on the mg road and accessible to every one ThanksPosted onTrustindex verifies that the original source of the review is Google. One of the best institute of BIM Architecture in Trivandrum. Got placed in one of the best company. Thanks Ananthu Sir for your support.Posted onTrustindex verifies that the original source of the review is Google. Iam studying Accounting Course in this imstotution. They are providing good teaching and good facilities. They very friendly staff's. I suggested you for joing this institution. Becouse Inspiro Edutech is the best training institutions in thiruvananthapuram.Posted onTrustindex verifies that the original source of the review is Google. I am doing graphic design course in inspiro edutech Thiruvananthapuram. They are providing good teaching and good facilities.Posted onTrustindex verifies that the original source of the review is Google. I visited this institute for more courses, they are providing a good atmosphere and very friendly teams. This is one of the best training institutions in Trivandrum.Verified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more

FAQ

Have Questions? We Have Answers

The duration of the DCBAT course typically ranges from 12 months, depending on the learning mode.

Candidates who have completed Plus Two (12th grade) or above are eligible. This course is ideal for commerce graduates, accounting professionals, tax consultants, entrepreneurs, and individuals aspiring to build a career in corporate accounting and taxation.

Students will gain hands-on experience with Tally, GST and Income Tax filing software, MS Excel for accounting, and government tax portals for compliance and filings.

Yes, upon successful completion, students will receive an industry-recognized certification from Inspiro Edutech, validating their expertise in corporate business accounting and taxation.

Yes, Inspiro Edutech offers placement assistance by connecting students with job opportunities in accounting firms, corporate finance departments, and tax consultancy firms.

Absolutely! The course includes real-world case studies, hands-on projects, and practical exercises to ensure students gain practical experience in corporate accounting, taxation, and compliance.

Join Inspiro Edutech

Take your career to the next level with the Diploma in Corporate Business Accounting & Taxation (DCBAT) at Inspiro Edutech. Our expert-guided curriculum, hands-on approach, and career support ensure you’re ready to thrive in the competitive world of corporate accounting and taxation.

Available Locations: Trivandrum, Kazhakoottam, Attingal, Neyyattinkara, Parassala, Balaramapuram, Karmana, Venjaramoodu, Kattakada, and Nedumangad.

Enroll now to gain the skills and knowledge necessary to excel in the field. Join Inspiro Edutech and unlock a world of opportunities in corporate business accounting and taxation!